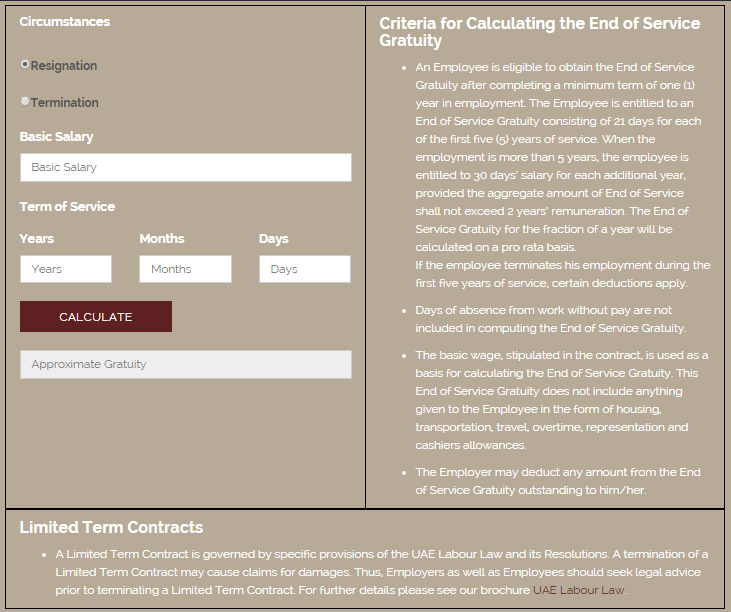

Gratuity Calculation in the UAE

At the termination of employment contract an employee in the UAE is entitled to a set of various things. One of them is the end of service gratuity which is calculated on employee’s duration of the employment.

In terms of compensation, the term end of service gratuity mean that an employee who completes one year or more in continuous service shall be entitled to gratuity at the end of the service. The gratuity is calculated as follows:

21 day’s wages for each year of the first five years.

30 day’s wages for each additional year on condition that the total of the gratuity shall not exceed the wages of two years.

How to Calculate Gratuity in the UAE

When an employee has completed one year of employment with the employer, gratuity is calculated on an annual basis. The day of absence from work without pay shall not be included in calculating the length of service. However, if the employee completed a year in service s/he will be entitled to a gratuity for the fraction of the year proportional for the part of the year s/he spent in work provided that he has completed one year in continuous service.

Click the link to use the gratuity calculator now.

Last basic wage received by the employee, before the termination of his/her employment contract, is considered as the unit for gratuity calculation. A basic wage means anything received by the employee as a wage excluding housing, transport, travelling allowances and overtime, family allowances, entertaining allowances and any other allowances or a bonus. This wage is taken as the unit for calculating the gratuity for all the years during which the employee has worked for the employer.

Deduction of Payment from the Gratuity

The employer may deduct any amount due and payable to the employee to the employer from the end of the service gratuity and make payment for the balance to the employee. If there is any dispute over payment of gratuity or amount payable to the employer, the matter should be put to the labour office for mediation.

Calculation of Gratuity when the Employee Resigns from Employment

If an employee employed under a contract for unlimited period resigns after a continuous service of not less than a year and not more than three years then s/he is entitled to one third of the end of service gratuity. If the period of continuous service was more than three years and less than five years s/he is entitled to two thirds of the gratuity. If his continuous service is more than five years, s/he shall be entitled to the full gratuity.

If an employee who is employed under a contract of limited period, resigns with his free will before the end of the contract, s/he shall not be entitled to the end of service gratuity unless his continuous service exceeds five years.

Gratuity Due and Payable

Gratuity will only become due and payable at the end of or at the termination of the contract.