Free Zone Business Setup

Free zone business setup is an ideal option for those who need 100% ownership of the business and also do not want the overhead of local partner. There are numerous free zones in Dubai and the UAE and they are isolated lands or settings, with a special tax, customs and imports regime and governed by their own framework of regulations (with the exception of UAE Criminal Law). The UAE has several free zones across Dubai, Abu Dhabi, Sharjah, Fujairah, Ajman, Ras al Khaimah and Um Al Qwain. Free Zones may also be broadly categorized as sea port free zones, air port free zones, and mainland free zones.

A free zone business setup has many attractions such as for each free zone there is a separate body structure or authority which is responsible for the management of that free zone. The authority is responsible for issuing licenses and employee visa. Each free zone authority has its own rules and regulations to issue licenses. There are no taxes for free a zone business setup, 100% foreign ownership and customs privileges. This makes the free zones the most favorable locations in the Middle East for international operations.

Azhari Legal Consultancy provides a full range of certified services for your business to start a free zone company successfully in most free zones. We provide all support which you may require for registration of your new company and employment visas.

To speak to our customer service representative, contact us now!

Characteristics of Freezone Company Formation:

100% Ownership

Freezone business setup is the best option for the expatriates because 100% ownership is given to foreign investor in a free zone.

Tax exemption

The second main reason for having a freezone company setup is the tax exemption. In the UAE all free zones are tax free.

No trade barrier

Business setup in a free zone has no trade barrier. So any free zone company can have its own decision to trade with other companies all over the world with no limitation of trade quota.

Virtual office and flexi desk

Virtual office and flexi desk options provide a huge cut in the cost which otherwise is incurred for the office infrastructure, furniture, office supplies and management staff.

No import and export duties

Most freezone busiess setups have no import and export duties and have no limitation on hiring employees outside their jurisdiction.

Availability of workforce

Due to high quality of life style and facilities, skilled workforce is attracted towards the UAE. Thus, this workforce is always available at negotiable terms.

Confidentiality

Another important characteristic of a free zone company incorporation is confidentiality. The assets are kept confidential for all the owner of the free zone companies by the authorities of free zone.

Advantages of Freezone Company formation

- 100% foreign ownership is allowed

- 100% repatriation of capital and profits possible

- Zero personal or corporate income taxes, customs duties and import/export taxes

- Very few restrictions on recruiting labour

- Shared services and synergies with other companies

- No bureaucratic red-tape

- State of the art infrastructure

- 3 years UAE residence visa

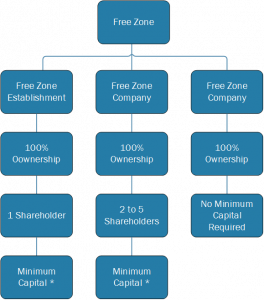

Types of Entities

(* Depends on the particular free zone)

We at Azhari Legal Consultancy supervise the entire process of incorporation for our clients. It includes:

- providing strategic input

- organizing business plan

- getting approvals and clearances from various departments of the Free Zone

- drafting relevant legal documents

- helping to open bank accounts

- handle other documentation formalities